Research and Development (R&D) tax credits can have a great financial benefit by either reducing your company’s Corporation Tax liability or HM Revenue & Customs (HMRC) making a payment to your company. HMRC even offer to give Advance Assurance for qualifying small and medium enterprises (SMEs) before you claim R&D tax relief. This gives you the peace of mind that HMRC will agree with the R&D tax credit before the claim is processed.

What are R&D tax credits?

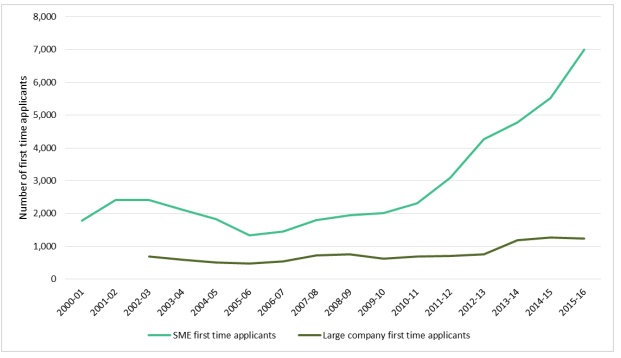

R&D tax credits were set up by the UK government in 2000 as a tax relief designed to increase spending in R&D. The main idea is that this would lead to greater investment in innovation. Recent statistics released by the government show more and more companies are now claiming R&D tax credits for the first time since the launch as shown in the table below.

Number of first-time applications by financial year, 2000-01 to 2015-16

Source: HMRC (2017) Research and Development Tax Credits Statistics, report available online.

However, studies suggest that many companies are still unaware of or underestimate the massive financial benefit of R&D tax credits. Don’t let your company miss out on this most effective and generous tax relief.

What are the financial benefits of claiming R&D tax credits?

Under the SME scheme, businesses can enhance their R&D qualifying expenditure by 130%, which reduces taxable profits and the overall Corporation Tax liability. If the company is loss-making, in some circumstances companies can surrender their losses in return for a tax credit paid back to the Company from HMRC. Some clients have funded projects based on these refunds.

Under the large company scheme companies can claim a Research and Development Expenditure Credit (RDEC) for working on R&D projects. It can also be claimed by SMEs and large companies who’ve been subcontracted to do R&D work by a large company. The RDEC is a tax credit for 11% of your qualifying R&D expenditure up to 31 December 2017, 12% from 1 January 2018 and 13% from 1 April 2020.

Does your company qualify for R&D tax credits and what costs qualify?

The requirements are purposefully broad and can include:

- Creating new processes, products or services,

- Making appreciable improvements to existing ones

- Using science and technology to duplicate existing processes, products and services in a new way

The usual questions we would ask are:

- What R&D activity is the company undertaken?

- What is the scientific or technological advance being sought?

- What are the scientific or technological uncertainties involved and how does the project plan to deal with these uncertainties?

- Why is the knowledge being sought not readily deducible by a competent professional?

Your project doesn’t have to have been successful to qualify and you can include client work as well as your own.

The types of costs that can qualify for R&D tax relief is extensive and can include:

- Direct and externally provided staff

- Subcontracted R&D

- Consumables

- Software

- Trials and prototyping

- Independent research costs

What is the time limit for making an R&D tax credit claim?

Companies that qualify for R&D tax credits can make a claim up to 2 years after the end of the accounting period. For example, if a company wants to process an R&D tax credit claim for the year ended 31 December 2016, the deadline to resubmit the tax return would be 31 December 2018.

We can help you to claim R&D tax relief

At Ellacotts, we have a specialist Corporate Tax team who have significant experience assisting companies with Research and Development claims. This includes judging which projects and activities will qualify and we can review whether you can increase existing claims.

For more information and to see whether you can make a claim please contact Alex Westerman on 01295 205401 or awesterman@ellacotts.co.uk.