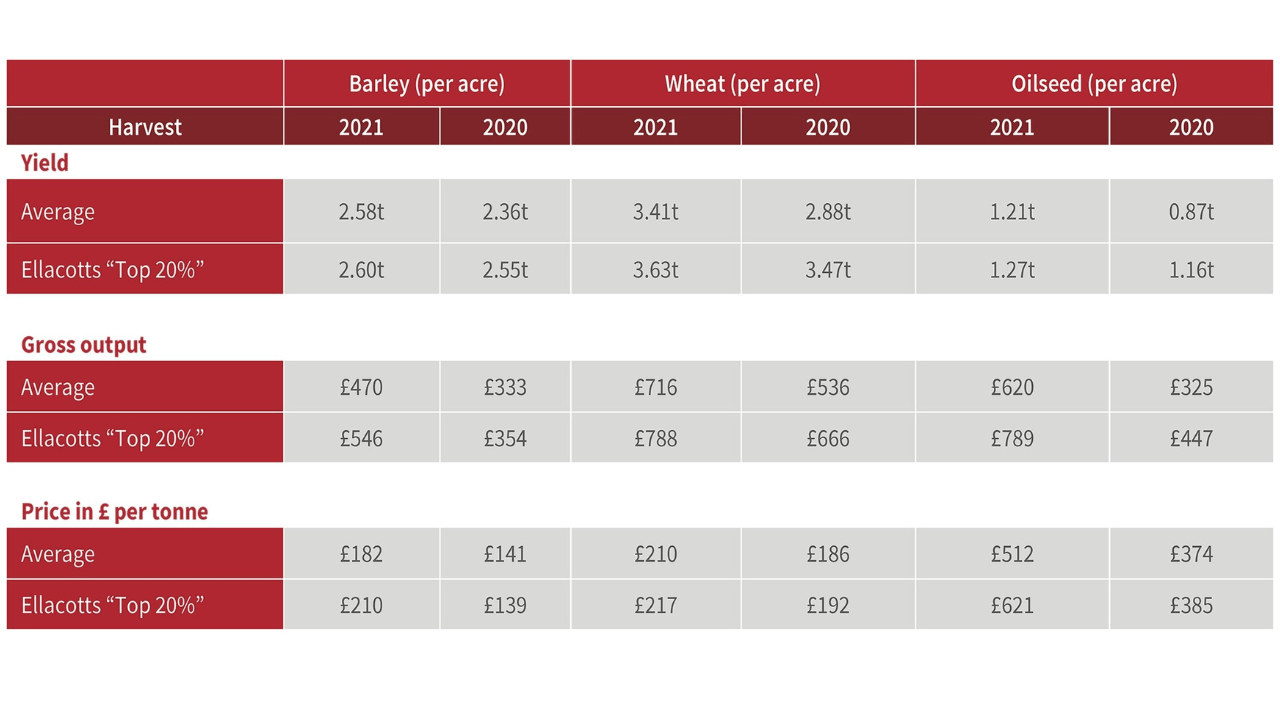

We have now completed about half of our gross margin accounts for the 2021 harvest across our portfolio of arable clients, covering over 50,000 acres. A comparison of the 2021 harvest against the 2020 harvest is summarised below:

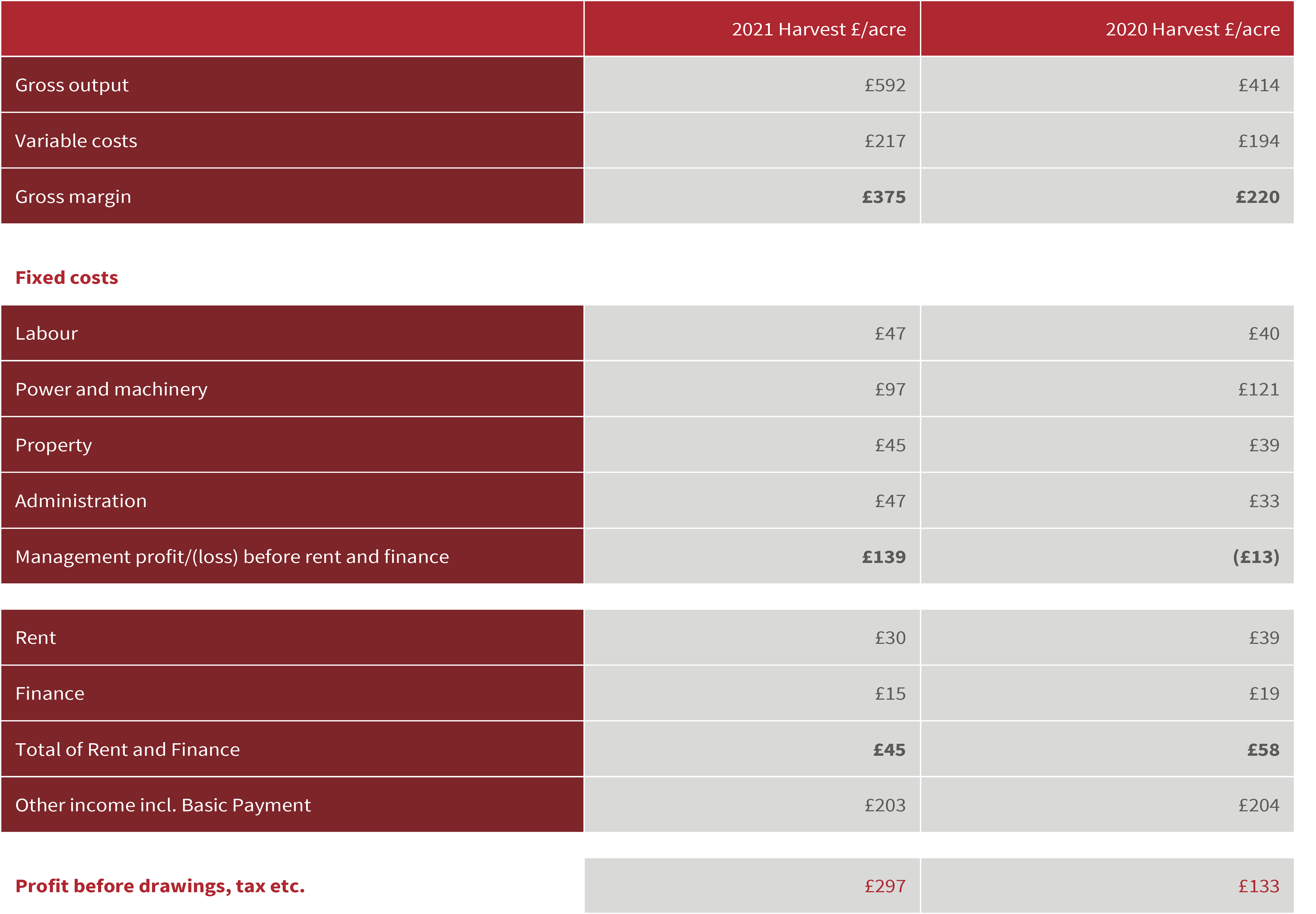

Financial position of the ‘average’ farm based on our portfolio of arable clients:

Key trends:

Outputs

Drilling conditions for the 2021 crop were promisingly dry but ended with a wet harvest. The strength of grain prices masked the poor weather come August and resulted in gross output for our average farm increasing £178 per acre from £414/acre to £592/acre.

Wheat yield for our top performers increased to 3.63t from 3.47t and impressively across all farms the yield rose to 3.41t from 2.88t. With the price of wheat up by £24 to £210 per tonne, this resulted in a strong gross output of £716/acre up £180/acre from the 2020 harvest.

Oilseed rape output shows an increase of £342/acre to £789/acre for our top performers, with the result for our average farm reflecting a similar trend.

Barley yields have increased from the 2020 harvest but not quite as significantly as wheat and oilseed rape. The barley price for top performers increased by £71/t to £210/t. The strength of the grain market allowed the overall gross output for both our top performers and average farm to rise significantly compared to the 2020 harvest.

Inputs

Wet weather meant much of the 2021 harvest had to be dried. The increase in 2021 variable costs was predominantly due to drying costs.

All other inputs remained consistent with the 2020 harvest. Higher fertiliser costs didn’t affect the 2021 harvest but will be a significant factor for the 2022 harvest.

Fixed costs

Farmers have been looking at fixed costs and reducing these where possible although it is difficult to see where any significant savings can be made.

Labour costs were up £7/acre mainly due to cost of living increases having a knock-on effect on wages payable to both full-time and temporary workers.

Agricultural rents appear to have reduced slightly.

Conclusion

In the short term, buying and selling in volatile markets makes for an uncertain future and will be crucial to the financial success of the business.

Longer term, the impact of the gradual removal of the Basic Payment is known, but the support thereafter is still uncertain. Significant reductions in support are inevitable. Our farmers are facing changes which will have a huge impact on future farming strategy. Good advice and business planning will be key.

Information for readers: This material is published for the information of clients. It provides only an overview of the regulations in force at the date of publication, and no action should be taken without consulting the detailed legislation or seeking professional advice. Therefore no responsibility for loss occasioned by any person acting or refraining from action as a result of the material can be accepted by the authors or the firm.