Even now, given the current market volatility, pensions remain one of the most tax-efficient investments you can make. Tax relief gives an immediate 25% ‘uplift’ on your contribution, and the funds are protected from tax on death until age 75 regardless of whether or not benefits have been taken. Currently, a tax-free lump sum of 25% of the fund is paid to you when you take benefits.

Annual pension contribution limit

There is an annual limit on the amount that can be contributed to your pension each year. In simple terms, this is 100% of your earnings from trade up to a maximum of £60,000.

With some forward planning, you can benefit from a much larger allowance. This can enable you to reduce your tax liability in times of ‘super profits’. We will show you how to increase your allowance.

How to maximise your pension contributions

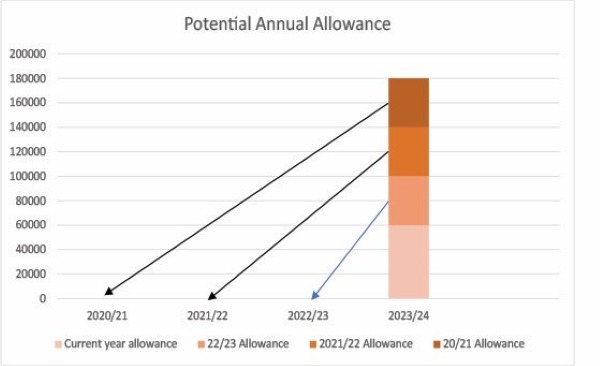

Let’s assume you have not made a pension contribution for a few years, but you have done in the past. You will be able to benefit from the carry-forward rules. These enable you to make pension contributions for the current year and also the previous three years meaning you can contribute up to £180,000 to your pension. You have to have sufficient earnings in the year of contribution to be able to do this.

In order to use carry-forward allowances, you must first maximise contributions for the current year. Then you use available allowances from the earliest year first.

The graph below illustrates how contributions would be allocated. Remember, the contribution of £180,000 would only cost £144,000 after basic rate tax relief. You would also receive a further credit of at least 20% via your Self Assessment tax return, meaning the overall outlay, after-tax relief is only £108,000.

As you can see, a contribution paid in the current year would maximise all allowances available going back to 2020/21.

With proper advice and consideration of both market risk and the investor’s attitude to risk, times of stock market fluctuation such as these can benefit those willing and able to invest.

We can help you with your pension

If you would like further information on pensions, please contact our Wealth Planning team on info@ellacottswealth.co.uk or 01295 250401.

Information for readers: This material is published for the information of clients. It provides only an overview of the regulations in force at the date of publication, and no action should be taken without consulting the detailed legislation or seeking professional advice. Therefore no responsibility for loss occasioned by any person acting or refraining from action as a result of the material can be accepted by the authors or the firm.